Case study

InvestCo

Executive Summary

InvestCo, a seasoned multinational investment firm, conducted a comprehensive internal and portfolio assessment using the WhatTheForesight (WTF) tool. This in-depth analysis revealed a nuanced picture of the company’s strengths, weaknesses, opportunities, and threats.

A key finding from the internal assessment is a significant divergence in perceptions between executive and lower-level management regarding the company’s current state and future potential. This disparity underscores the need for improved communication, transparency, and alignment. To foster a culture of innovation and drive long-term growth, InvestCo must prioritize technology adoption, invest in its workforce, and cultivate a mindset of continuous improvement for itself and across it’s investments.

The portfolio assessment revealed a diverse range of company performances. While some companies demonstrate strong growth potential, others may be facing challenges related to leadership, culture, or technology adoption. By identifying these areas, InvestCo can allocate resources effectively, provide targeted support, and drive value creation. A key strategy to consider is a focused approach to portfolio management, identifying core holdings and emerging opportunities.

To navigate the increasingly complex and dynamic investment landscape, InvestCo must cultivate a culture of adaptability and resilience. Balancing short-term gains with long-term sustainability is crucial by identifying which investments provide adequate growth and scaling over the relevant time required for internal ROI. Regular assessments, strategic reviews, and a willingness to pivot when necessary will enable the company to adapt to changing market conditions and capitalize on emerging opportunities.

WTF provides a valuable roadmap for InvestCo to enhance its internal operations, optimize its portfolio, and secure long-term success. By addressing the identified challenges and leveraging the opportunities, InvestCo can strengthen its position as a leading investment firm, deliver exceptional value to its stakeholders, and achieve sustainable growth augmenting its long history with predictive analytics and data driven insights. This approach could be used for other investment companies looking to enhance its portfolio.

Client Overview: InvestCo

InvestCo is a multinational investment firm with over three decades of experience investing in financial services companies with a presence in local and international markets. Despite its extensive portfolio, the investment team remains relatively small, tasked with responsibilities spanning the entire lifecycle of investments—from prospect screening and due diligence to advisory, operational oversight, and board-level interventions.

Given the dynamic nature of its portfolio, which ranges from traditional financial services firms to lean, tech-driven disruptors, InvestCo sought to trial WTF (WhatTheForesight) as a tool to complement its qualitative assessments with robust, quantitative insights. The goal was to evaluate whether WTF could offer deeper alignment between InvestCo’s external assessments and the internal realities of its prospective and portfolio companies’ staff, particularly beyond the narrative presented by CEOs and leadership teams.

The Challenge

In the highly competitive world of venture capital, private equity, and portfolio management, decisions rely heavily on accurate and actionable insights. However, one of the persistent challenges for investment firms is assessing the true state of a company. While CEOs and founders often provide polished presentations and documents, these can overstate readiness, market fit, or operational stability—intentionally or otherwise.

For InvestCo, this represented a critical gap; while traditional business plans and strategy documents offer important context, they often fail to uncover underlying cultural dynamics, organizational health, and operational challenges. These internal factors can act as early indicators of whether a company is positioned for scalable growth or poised to underperform that are often imperceivable to an external party without daily interaction with a portfolios entire team – an impossibility for Investco that while building relationships with its portfolio is impossible given the small team with limited times.

The spectrum of companies in InvestCo’s portfolio further complicated this challenge. On one end were legacy financial services firms with limited technological adoption, operating on traditional models, to the other extreme: agile, risk-taking companies leveraging digital-first platforms to drive growth as a highly scalable model that leverage extensively on the potential technological gains. Bridging these extremes required a tool that could offer scalable, comparable, and data-backed insights across varying levels of risk, maturity, and operational complexity. It would also need to measure across a common set of metrics for comparisons and benchmarking for further analysis.

WTF Deployment: Evaluating the Portfolio and InvestCo Itself

InvestCo piloted WTF across its 16 portfolio companies and within its own investment team. The goal was multifaceted:

- Portfolio Validation: Align the investment team’s perceptions of portfolio companies with the companies’ internal realities and bring a quantitative measure to qualitative indicators

- Self-Assessment: Gain insight into InvestCo’s leadership perceived the organization’s current state and future potential compared to its portfolio.

- Benchmarking and Stack Ranking: Use WTF to create a quantitative scorecard for the portfolio, enabling peer learning among the investments and providing InvestCo with a balanced metric to evaluate portfolio quality beyond traditional financial indicators.

An additional objective was tied to internal changes within InvestCo. With the arrival of a new CEO, the organization sought to survey its leadership team both before and after the CEO unveiled his strategic vision. This dual-phase survey aimed to measure any longitudinal shifts in perception regarding InvestCo’s future direction following the CEO’s inaugural address and sharing of his business strategy.

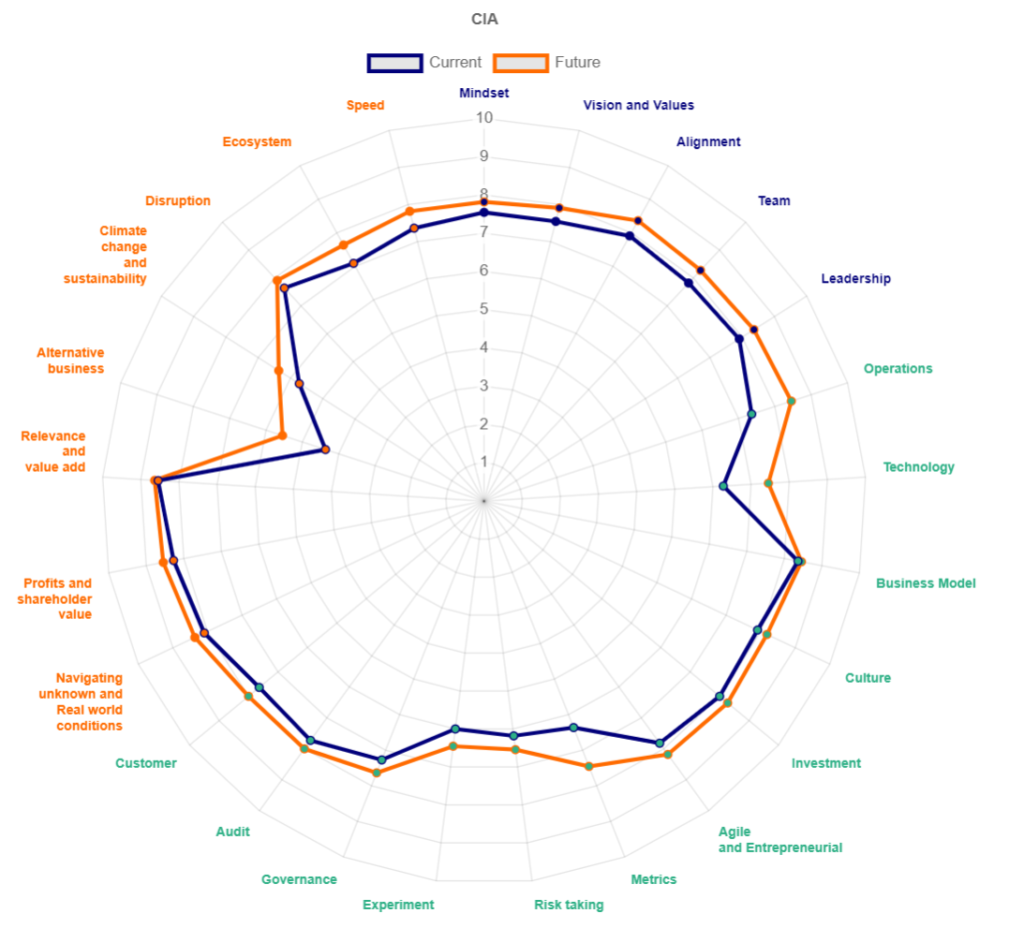

Initial Self-Assessment

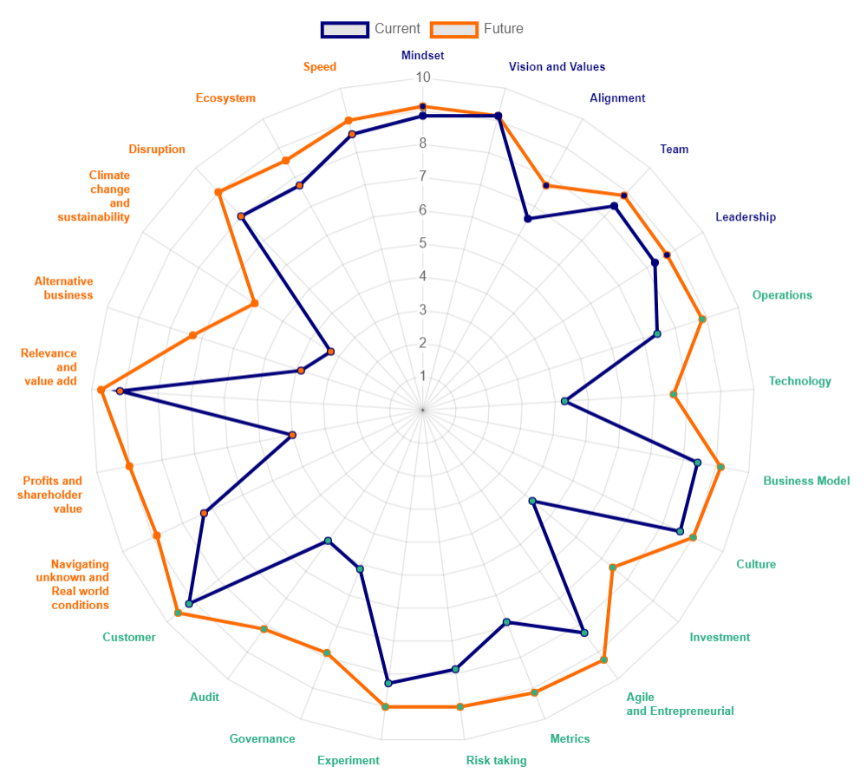

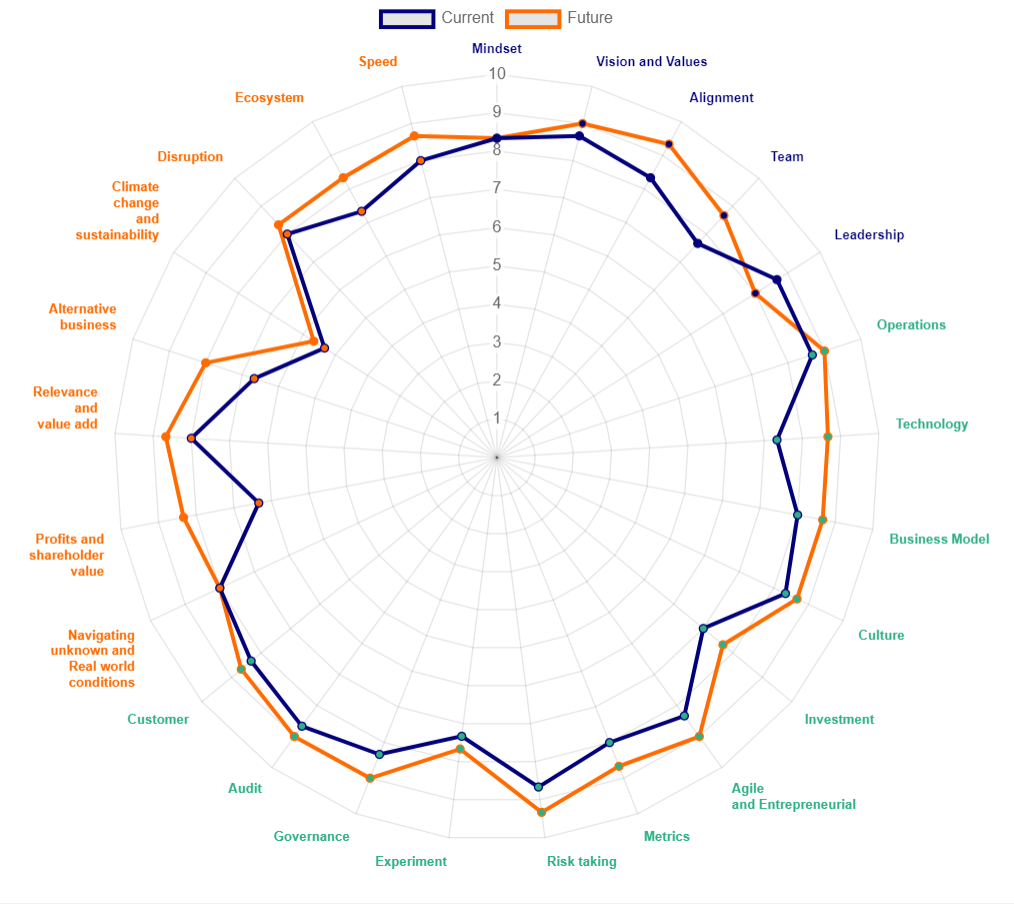

The first survey, conducted with a sample of seven executives, revealed key insights into InvestCo’s current and projected trajectory. The results, visualized through WTF’s perception curves, compared current perceptions (blue curve) with future perceptions (orange curve).

- Overall Trajectory: The orange curve consistently outperformed the blue (i.e. closer to the circumference), indicating optimism about InvestCo’s future growth and strategic positioning.

- Growth Limitations: Despite this positive trajectory, the deltas between the blue and orange curves were relatively small in some areas, with certain metrics showing no anticipated improvement. This suggested a perception that InvestCo might be nearing the upper limit of its growth potential, highlighting areas requiring renewed focus or reinvention to maintain long-term competitiveness.

Key Insights from Leadership, Organizational, and Landscape Metrics

The WTF analysis revealed several challenges and opportunities for InvestCo, particularly across leadership, organizational, and landscape metrics. These insights provide actionable recommendations for the new CEO as he seeks to drive alignment and growth.

Leadership

The analysis identified gaps in alignment and leadership perception among survey respondents. This could stem from a lack of a cohesive strategy under the newly installed CEO, leading to uncertainty among leadership. Alternatively, these gaps may reflect long-standing challenges that predate his tenure, requiring deeper cultural and structural interventions to resolve. Building alignment across the leadership team should be a priority to ensure cohesive execution of the company’s future strategy.

Organisation

Within the organizational “bucket,” WTF highlighted stagnation in critical areas, suggesting that several attributes may have reached their perceived ceiling.

- Investment: Both current and future perceptions of investment hovered around 6.4, showing no expected growth. This lack of movement points to a potential need for the CEO to prioritize renewed capital allocation strategies that can drive meaningful organizational change or share more details on future investment (if applicable), hence this could also be interpreted as an internal communication issue.

- Customer Focus and Experimentation: Both attributes showed minimal gaps between current and future states, with the absolute scores for “customer focus” peaking at just 7. These findings suggest that InvestCo must elevate its customer orientation and innovation efforts to remain competitive and agile in its evolving market.

- Opportunities for Improvement: While several metrics appeared capped, three areas emerged as priorities for growth:

- Technology Adoption: Current scores around 5, with a modest future projection of 6.2, indicate the need for greater reliance on advanced technologies to streamline operations and enhance efficiency.

- Culture: Current perceptions of 6.1, with future projections of 7.3, underscore the importance of fostering a stronger, more unified corporate culture under the new leadership.

- Audit and Resource Utilization: Here, “audit” extends beyond financial reviews to encompass the effective deployment of internal resources, including talent, institutional knowledge, and data assets. Current and future projections suggest a need to optimize these resources for better organizational alignment and operational efficiency.

Landscape

The landscape metrics largely reflected a perception that InvestCo has reached or is nearing its potential. However, two areas stood out as critical for future growth:

- Shareholder Value: Increasing shareholder returns must remain a top priority to maintain investor confidence and position InvestCo competitively in its sector.

- Alternative Business Models: Diversifying its business model offers an opportunity for InvestCo to augment its current operations and mitigate risks associated with relying solely on traditional financial services.

These findings provide the new CEO with a clear roadmap for intervention. By addressing leadership alignment, fostering a culture of experimentation and customer focus, and investing in technology and alternative business models, InvestCo can position itself for sustained growth and enhanced shareholder value

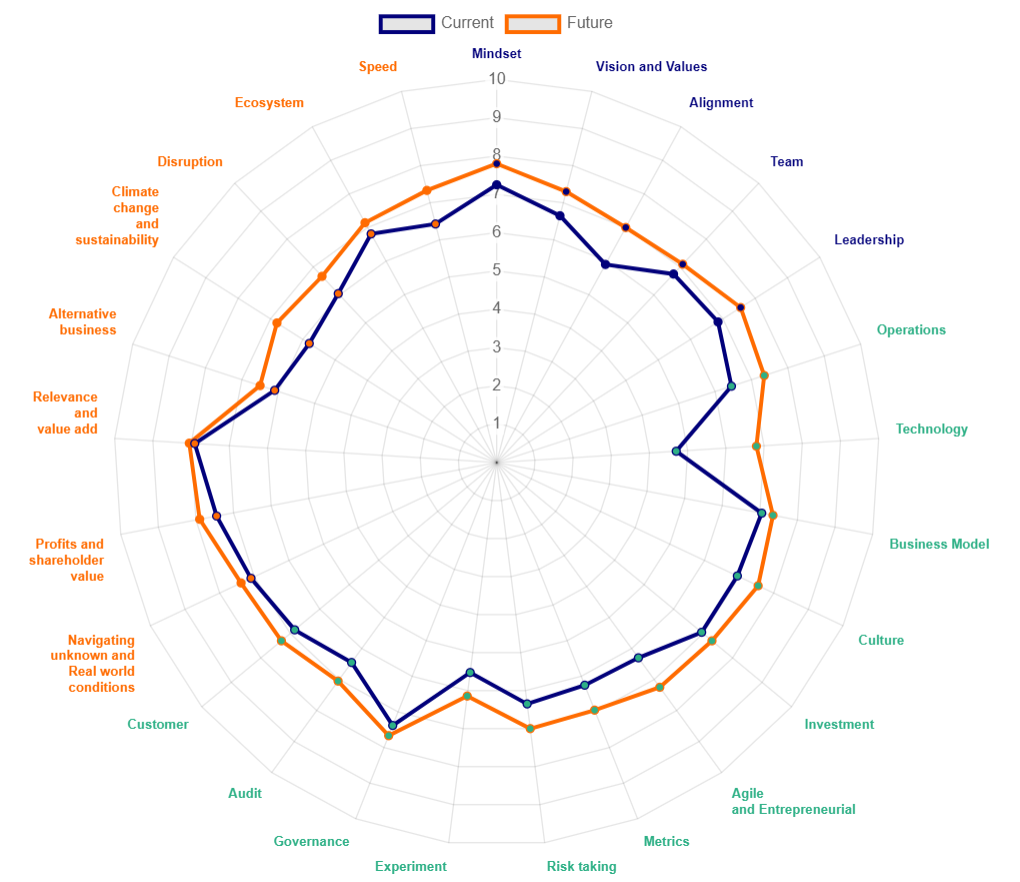

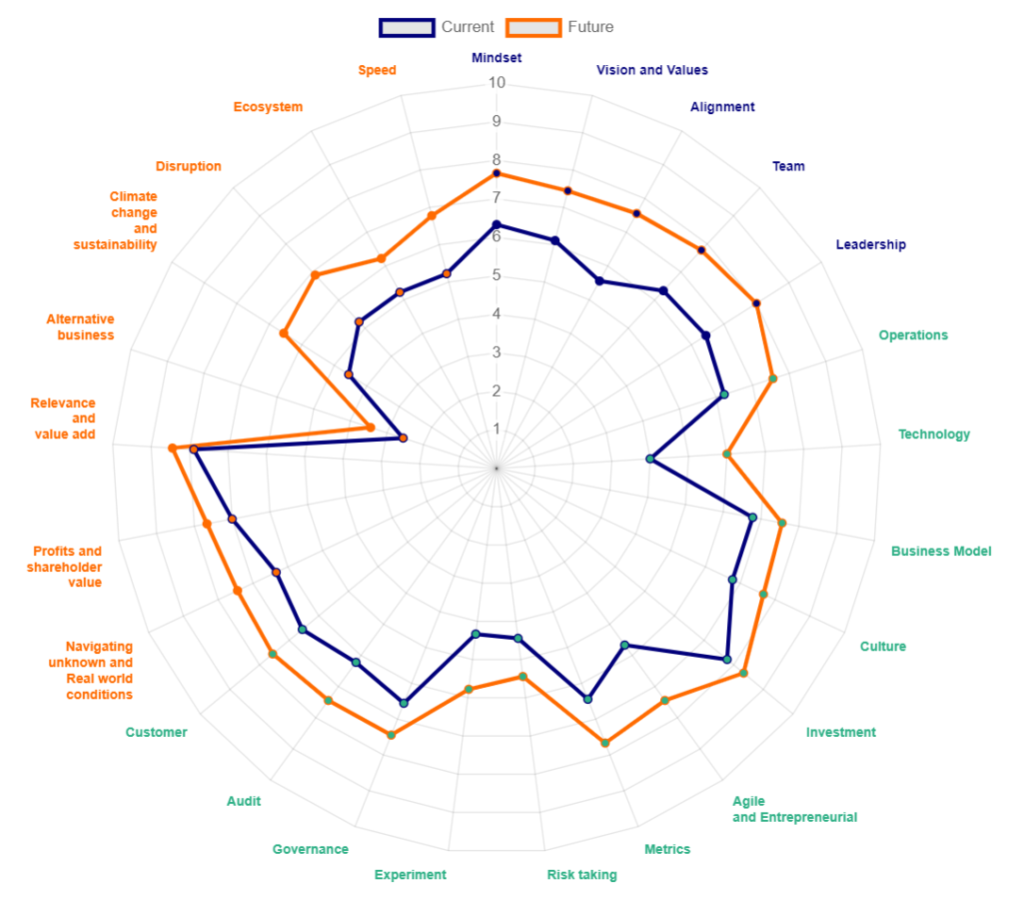

Second Round of WTF Surveys: Tracking Shifts in Perception Post-CEO Strategy Presentation

Following the initial round of WTF surveys, InvestCo expanded the respondent pool for a second iteration to assess any shifts in perception. The second round included 20 participants, comprising the original seven executives and an additional group of management team members. This broader sample aimed to provide a more comprehensive view of the organization, especially after the new CEO shared his vision and strategic roadmap for InvestCo.

Key Insights from the Second Round

The second round of WTF surveys showed minimal variation from trends from the first round, with most metrics reflecting the previously observed trends. However, two notable insights emerged

1. Technology Perception Gap

The perceived use of technology showed a notable increase from 4.8 to 6.8, representing a significant positive shift in sentiment either a result whereby respondees again believe technology as a key driver for growth. This 2 basis point is greater than 1.5 basis points for just the initial executive teams views which may demonstrate a greater need to technology adoption for management or that the CEO focussed upon this in his inaugural strategy session.

2. Perceived Growth Ceiling

Similar to the first round, the curves from the second survey (grey) indicated close clustering between current and future perceptions, suggesting a continued belief that InvestCo may have reached its perceived upper limit for growth across several attributes.

Overlay Analysis: Pre- and Post-CEO Vision

Overlaying the future perceptions from both rounds of WTF surveys revealed a higher level of convergence between the two groups—executives alone in the first round and executives with management in the second. While the second-round responses were generally more optimistic about leadership and organizational metrics, they reflected less alignment in landscape attributes compared to the first round. By and large, the future perceptions of InvestCo showed greater consistency across both groups than their current-day evaluations, signaling increased alignment on long-term priorities.

Pink: 1st WTF

assessment

1. Leadership

The second set of surveys (grey curve) showed a distinct improvement in all leadership-related metrics compared to the first (pink curve). This suggests that the CEO’s presentation of his vision and strategy positively influenced perceptions of leadership across the board, signaling increased confidence in the leadership team’s direction.

2. Organisational

Most metrics in this category also showed improved perceptions post-presentation, with the grey curve closer to the circumference than the pink curve. The exception was Technology Use, where the second-round perception was lower. This may reflect heightened awareness among respondents of the organization’s underutilization of technology, possibly influenced by the CEO’s emphasis on its importance during his presentation.

3. Landscape

Interestingly, the landscape metrics displayed a reversal of the positive trends seen in leadership and organizational buckets. The pink curve was closer to the circumference, indicating greater external pressures and challenges perceived post-presentation. Key attributes like Navigating the Unknown, Profits and Shareholder Value, Climate Change and Sustainability, and Disruption showed increased salience. This may reflect a more realistic awareness among respondents of the external challenges that’s may have been highlighted in the CEO’s strategic overview.

The comparison between the two rounds of surveys illustrates the value of WTF in tracking perception shifts over time, providing actionable insights that align leadership priorities with organizational realities. By leveraging these insights, InvestCo can refine its strategy, build internal alignment, and better position itself to navigate external challenges.

Key Areas of Divergence

Despite the overall convergence, several future-focused attributes stood out with notable differences between the two survey rounds:

1. Business Model

The second-round respondents (executives and management) indicated a stronger need for emphasis on the future business model compared to the first-round respondents (executives only). This underscores a growing awareness at the management level of the importance of refining InvestCo’s core business model to remain competitive and scalable.

2. Agility and Risk-Taking

The second-round group also emphasized greater requirements for agility, an entrepreneurial approach, and risk-taking capabilities. This could reflect management’s closer proximity to operational realities, where adaptability is critical for navigating market uncertainties.

3. Governance

Governance emerged as another area where the second-round respondents highlighted greater future importance. This aligns with the increased complexity of managing a diverse portfolio and ensuring compliance, transparency, and robust oversight.

4. Growth Mindset

One of the most significant differences was in Mindset, specifically the adoption of a growth mindset. The second-round group expressed a stronger belief in the need for mindset improvement compared to the first-round group, suggesting a broader recognition of cultural shifts required to drive innovation and long-term success.

5. Profits and Shareholder Value

Conversely, the first-round respondents (executives only) placed a higher emphasis on future profits and shareholder value than the second-round group. This divergence may reflect differing priorities, with executives maintaining a sharper focus on financial outcomes, while the larger group of respondents considered broader organizational improvements. Alternatively, this shift could indicate a reduction in perceived importance over time as the larger group’s feedback brought additional perspectives to the forefront.

These findings provide actionable insights for InvestCo’s leadership team:

- Alignment on Business Priorities: The emphasis on business model innovation, agility, and governance highlights the need for InvestCo to align its future strategies with the expectations of both its executive and management teams.

- Cultural Shifts for Growth: The stronger focus on adopting a growth mindset from the second group points to a cultural opportunity for InvestCo to foster innovation, resilience, and adaptability at all levels of the organization.

- Balancing Financial and Operational Goals: The differing emphasis on profits and shareholder value reflects a potential gap in priorities between executives and the broader management team. Aligning these perspectives will be essential to ensure cohesive strategy execution.

- Leveraging Collective Insights: The convergence in future perceptions across both rounds suggests that InvestCo is moving toward greater alignment on long-term goals. However, the identified gaps underscore the value of continued dialogue and iterative feedback processes to refine priorities.

By addressing these disparities and focusing on shared priorities, InvestCo can ensure that its leadership and management teams are fully aligned on a cohesive vision for the future. WTF’s iterative analysis provided the clarity needed to identify these gaps, creating a foundation for informed, data-driven decision-making.

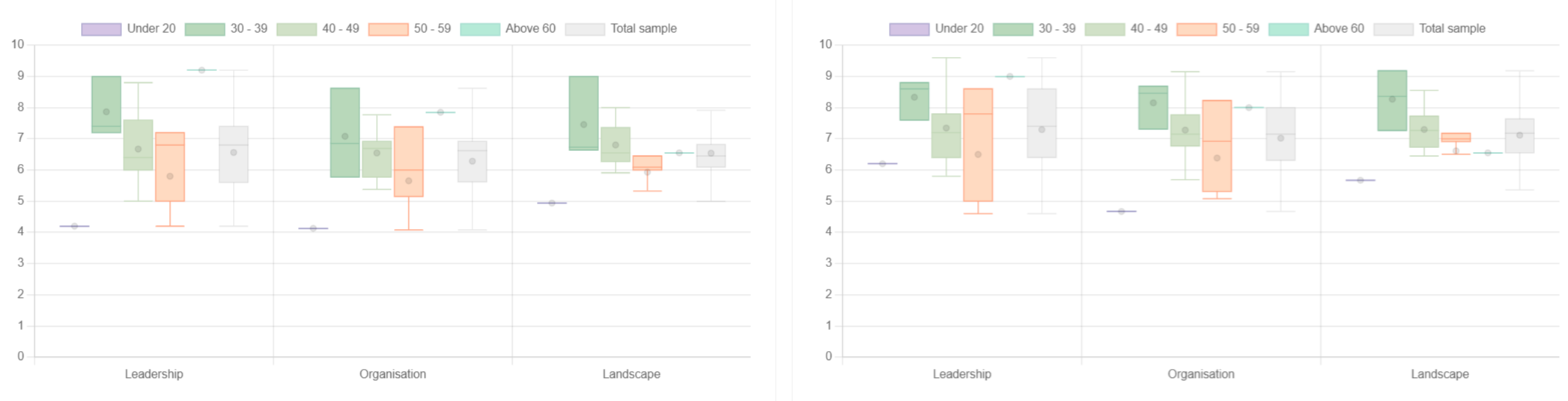

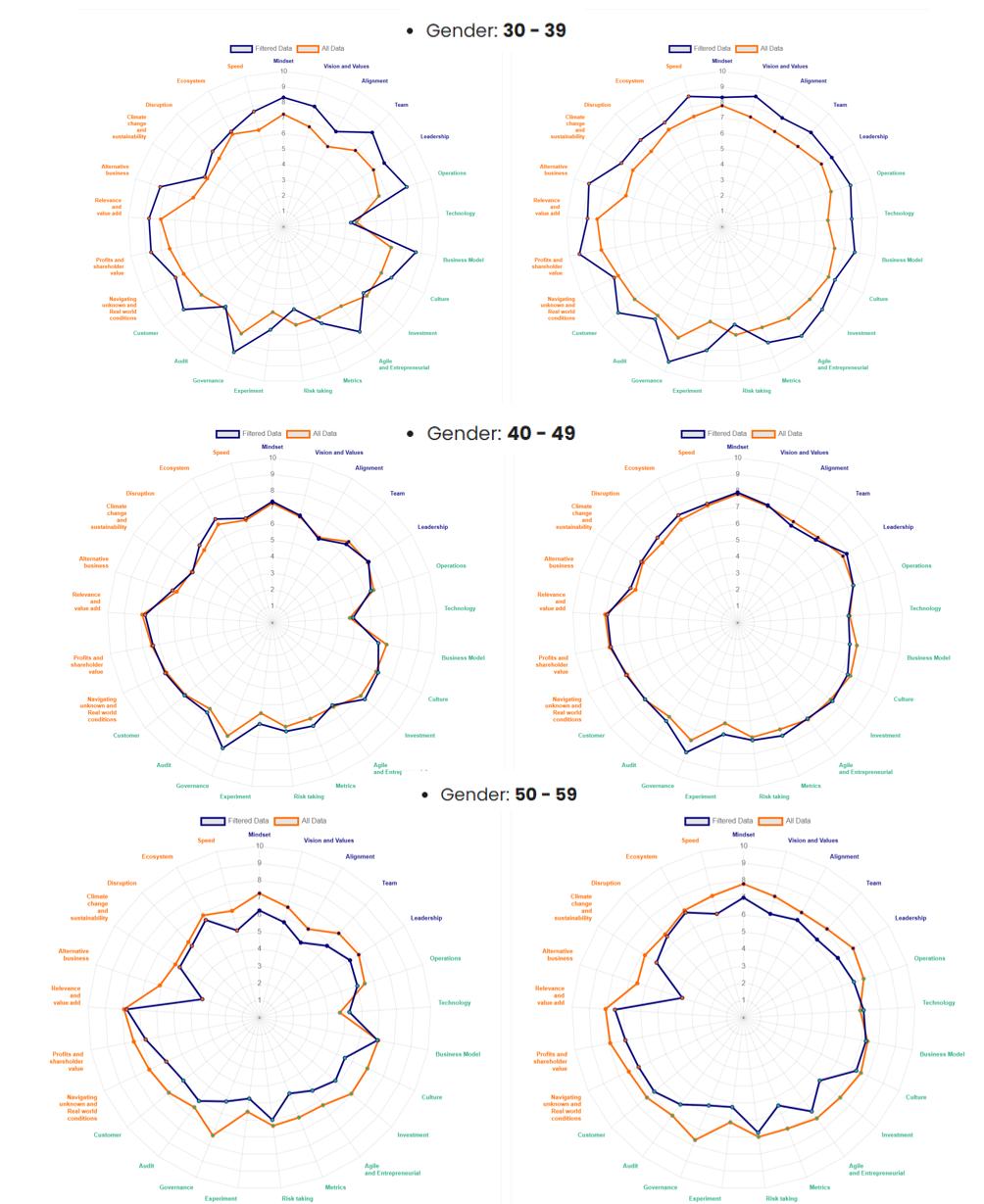

Demographic and Role-Based Insights

WTF’s demographic segmentation capabilities provided InvestCo with deeper insights into the perceptions of its workforce, uncovering concerning trends across both age groups and organizational roles. These findings offer a granular view of the organization’s internal alignment and areas requiring immediate attention.

When analyzing responses by age group (30–39, 40–49, and 50–59), a clear and troubling trend emerged: perceptions of InvestCo diminish significantly with age. This decline is consistent across both current and future metrics, suggesting either growing pessimism the longer employees remain with the company or a natural decrease in optimism as individuals move into older age brackets.

growing pessimism the longer employees remain with the company or a natural decrease in optimism as individuals move into older age brackets.

- Employees aged 30–39 demonstrated the highest optimism, with scores exceeding the organizational average.

- Perceptions among those aged 40–49 normalized, aligning closely with the overall organizational scores.

- Employees aged 50–59 were significantly more pessimistic, with scores well below the organizational average.

This trend raises concerns about the long-term engagement and morale of employees as they progress in their careers with InvestCo. It may also indicate deeper cultural or structural issues that diminish optimism over time. From a practical perspective, the 40–49 age group could serve as a reliable benchmark for a quick pulse-check on organizational sentiment, given their alignment with the broader sample.

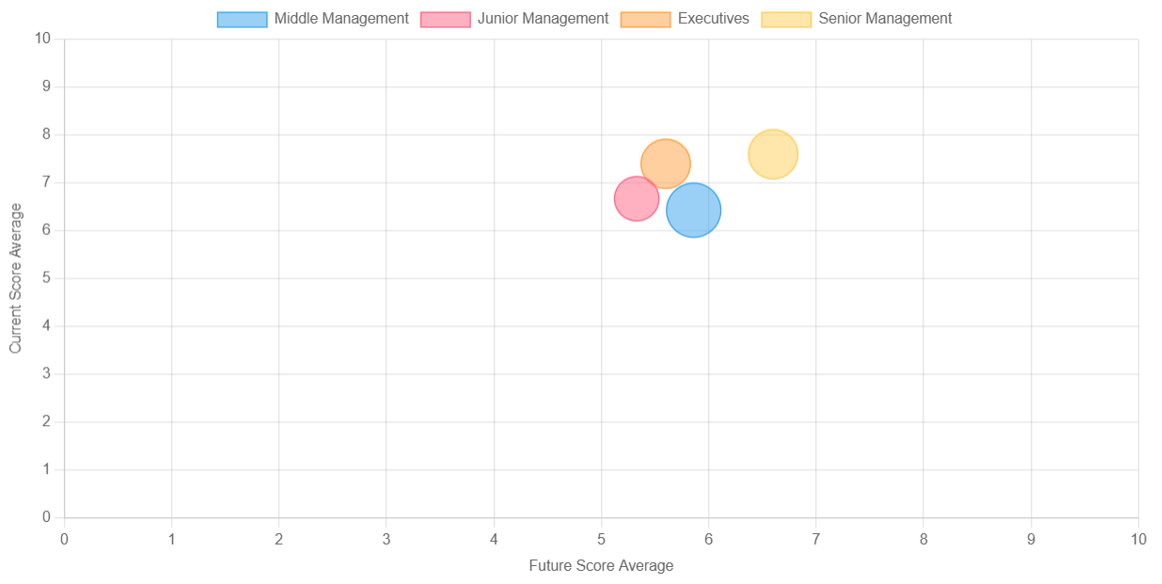

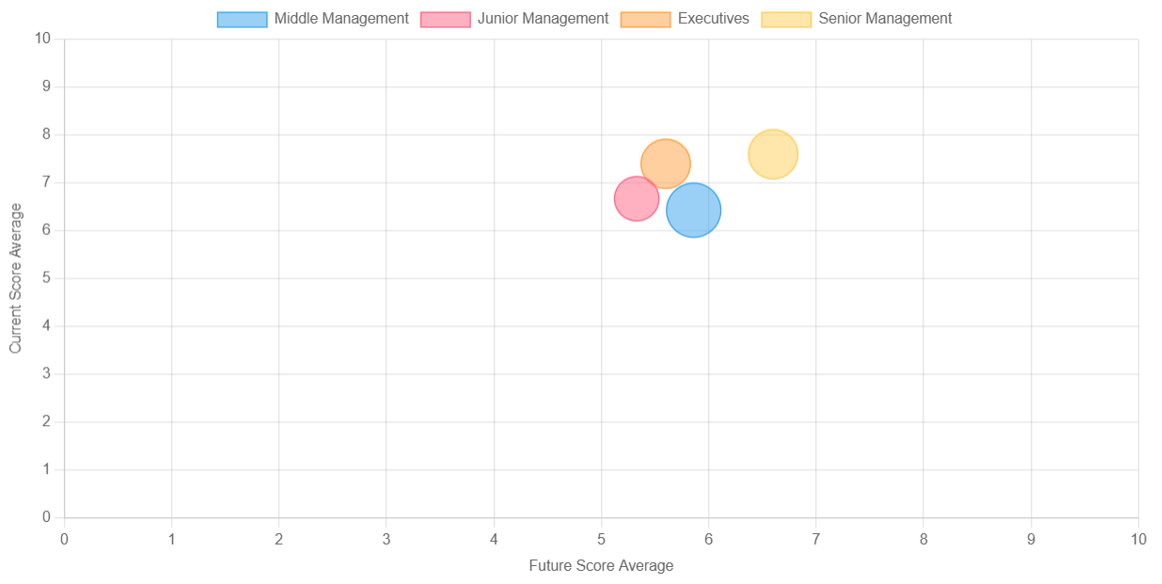

Role-Based Insights

Using role-based segmentation (junior, middle, senior, and executive management), WTF revealed notable disparities in perceptions across organizational levels:

- Technology Perception:

While all groups clustered closely regarding current technology use, junior management (3.8, compared to approximately 5 across other groups) is much more pessimistic about future potential highlights a need for targeted engagement and communication.

2. Alignment:

Senior Management showed the highest perceived alignment within InvestCo, scoring notably higher than other groups. This could suggest a disconnect, where senior leaders view alignment more favorably than it is experienced across the broader organization.

3. Culture:

Executives demonstrated far greater optimism about both current and future organizational culture compared to other groups, potentially indicating a misalignment with ground-level perceptions. Middle Management reported the lowest scores for current culture, diverging by approximately one basis point from junior and senior management. While their future cultural outlook aligned more closely, their perception of the present highlights immediate concerns.

These discrepancies suggest that executives may have an overly optimistic view of the culture they are creating, compared to how it is perceived by other levels of the organization. Middle management’s more negative perception of current culture could act as an early warning sign of deeper issues, warranting further investigation to avoid misalignment and disengagement.

These findings highlight critical challenges for InvestCo:

- Cultural Disconnection: Executives’ perception of culture significantly diverges from that of middle management, raising concerns about whether leadership is out of touch with the broader organization.

- Technology Engagement: Junior management’s pessimism about future technology use indicates a need to improve communication, training, and investment in technology to build confidence across all levels.

- Age-Driven Trends: The declining optimism with age underscores the importance of long-term employee engagement strategies and addressing potential structural or cultural factors that may erode morale over time.

By addressing these disparities, InvestCo can improve alignment, foster engagement, and strengthen its internal foundation for sustainable growth. WTF’s segmentation capabilities provide actionable insights to mitigate risks and enhance operational resilience.

Comparison of InvestCo and Portfolio Companies: A Technology and Future Outlook Gap

Pink: InvestCo assessment

Grey: Avg. across portfolio

In the second round of WTF surveys, InvestCo’s was furthermore evaluated alongside the broader portfolio of 16 companies who also used WTF. This comparative analysis revealed an important, and potentially problematic, trend: InvestCo scored lower than its portfolio companies in key areas, particularly around the use of technology.

Technology Gap:

InvestCo’s perception of technology, represented by the pink curve, was approximately one basis point lower than the portfolio average. This disparity highlights a potential misalignment between InvestCo’s executive team and its portfolio companies. While the portfolio is actively looking to integrate more advanced technological solutions, InvestCo’s leadership appears less inclined to adopt similar approaches internally.

This difference may reflect a belief among InvestCo’s executives that leveraging technology is more critical for their portfolio companies than for InvestCo itself. However, this perspective could hinder InvestCo’s ability to model best practices and lead by example, particularly as the financial services sector continues its rapid digital transformation. It could also show a disconnect between InvestCo appreciating the use of technology and its portfolio where this dissonance could result in future issues

Sharing of Governance best practices

InvestCo’s perception of governance is, unsurprisingly, much higher than the average across the portfolio likely driven by the fact that as an established global company there is a focus on governance with a properly equipped and skilled team of specialists. The average across the portfolio today demonstrates an obvious gap where InvestCo can share best practices with its investments and bring parity, as per the future scores being very similar.

Future Outlook Misalignment:

When examining future perceptions, InvestCo is notably less optimistic than its portfolio companies. This could indicate a mismatch in expectations, where the portfolio companies exhibit an inflated sense of future potential relative to InvestCo’s more tempered outlook. Alternatively, it may reflect a broader concern within InvestCo about its own ability to evolve in line with market demands.

This divergence between InvestCo and its portfolio raises important considerations:

- Technology Leadership: InvestCo’s hesitancy to embrace technology internally could undermine its ability to drive meaningful change across its portfolio. Closing this gap will require not only advocating for technological adoption among portfolio companies but also demonstrating a commitment to innovation within InvestCo itself.

- Alignment on Future Vision: The difference in future optimism suggests a potential disconnect between InvestCo’s leadership and its portfolio companies’ leadership teams. While not immediately detrimental, this misalignment could lead to challenges in strategic cohesion or investment decision-making down the line.

- Modelling Best Practices: For InvestCo to effectively influence and support its portfolio, it must ensure alignment in its values, priorities, and approach to scaling innovation. Leading by example, particularly in technology adoption, can strengthen its credibility as a strategic partner to its investments.

By addressing these gaps, InvestCo can better align with its portfolio, ensuring that its guidance and support reflect a shared vision for future growth. These insights from WTF provide a clear roadmap for enhancing cohesion and leveraging technology as a critical driver of success across both InvestCo and its portfolio companies.

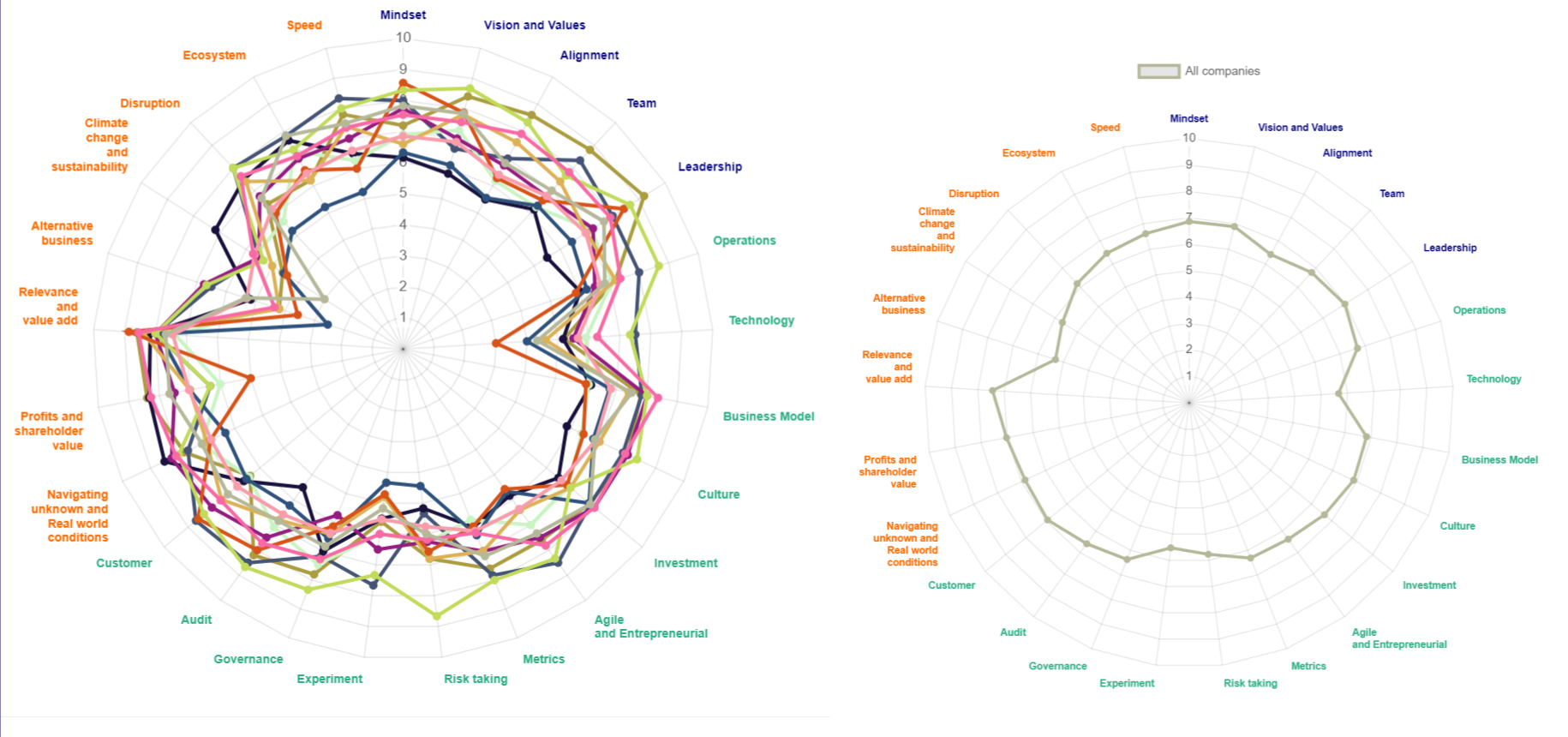

Portfolio Insights: Leveraging WTF Across 16 Investment Companies

WTF was deployed across InvestCo’s 16 portfolio companies to evaluate their current and future readiness across 25 attributes. While the comprehensive data set offers rich insights, certain trends and outliers provide immediate value for strategic decision-making.

Identifying Portfolio Outliers

The overlapping curves of the 16 portfolio companies reveal distinct strengths and weaknesses within the group:

- Risk-Taking: One company (light green curve) demonstrated a significantly higher score in risk-taking, suggesting a strong entrepreneurial and agile approach compared to the rest of the portfolio.

- Technology Adoption: Conversely, another company (dark orange) scored significantly lower in technology use, highlighting a gap that could impede operational efficiency and scalability.

These outliers provide InvestCo with a starting point to identify areas for intervention. For example, in the Landscape category, one company (light blue curve) consistently scored lower than its peers, indicating potential challenges in navigating external pressures, such as market disruptions or shareholder expectations. Similarly, in the Organizational category, another company (dark orange curve) scored notably lower across all metrics, suggesting deeper structural or cultural issues requiring targeted support.

Aggregated Portfolio Analysis

When the data from all 16 portfolio companies is aggregated into a single set of curves (right side), broader patterns emerge:

- Technology as a Key Delta:

Across the portfolio, the most significant gap between current and future perceptions lies in Technology Adoption. The aggregated score rises from 5.8 to 7.8, reflecting a two-basis-point improvement, far exceeding the average one-basis-point delta across other attributes. This underscores a clear portfolio-wide demand for greater technological integration and innovation, making it a priority area for InvestCo’s consulting and advisory efforts.

- Consistent Trends Across Other Metrics:

When normalized, most other attributes show minimal deltas, typically around one basis point. This alignment suggests general consistency in perceptions across the portfolio, with technology standing out as the most pressing opportunity for improvement.

WTF’s portfolio-wide insights provide InvestCo with actionable intelligence to inform its strategic support and oversight:

- Targeted Interventions: Identifying outliers—such as companies struggling with technology adoption or organizational alignment—allows InvestCo to deploy consulting and advisory services where they are most needed.

- Best Practice Sharing: Highlighting companies that excel in certain areas, such as risk-taking or innovation, creates opportunities for peer learning within the portfolio. Facilitating knowledge sharing can help underperforming companies adopt proven strategies.

- Technology as a Portfolio Imperative: The portfolio-wide emphasis on technology adoption presents InvestCo with a strategic opportunity to champion digital transformation across its investments, ensuring scalability, efficiency, and future readiness.

- Perception vs. Reality: WTF helps InvestCo distinguish between perception-based gaps and actual performance issues, enabling more precise interventions that address root causes rather than symptoms.

Analyzing Individual Portfolio Companies with WTF

The application of WTF to InvestCo’s portfolio allowed for a granular analysis of individual companies, revealing key insights into their unique strengths, challenges, and future potential. Below is a breakdown of findings for select portfolio companies:

Company A: Perceived Growth Ceiling

Company A’s perception curves indicate minimal deltas between current and future states, suggesting the company is nearing its perceived maximum growth potential. While this implies stability, it may also signal limited opportunities for further investment-driven growth

Company B: Greater Growth Potential

Compared to Company A, Company B’s curves show larger deltas and a higher future perception, indicating a more promising growth trajectory. If InvestCo faces resource constraints and must prioritize investments, Company B would be the logical choice, given its stronger growth outlook

Company C: Balancing Stability with Innovation

Company C is a well-established player operating in a traditional financial services model with a significant market presence and a quasi-monopoly in its sector. The data highlights the necessity for investment in alternative business models, though this must be considered in context. Given Company C’s entrenched market position, pivoting away from its core operations could be counterproductive.

However, one critical area for improvement is Technology Adoption. Company C scored significantly lower than the portfolio average (4.0 today vs. 6.0 in the future) and well below the portfolio-wide delta (5.8 to 7.8). This gap may reflect either a lack of appreciation for how technology could enhance scalability or an absence of technological capability among its workforce. Addressing this issue could unlock efficiencies and future-proof the business.

Company D: Leadership Concerns Amid Strong Metrics

Company D stands out for its high current and future scores across most attributes, averaging an impressive 8.1. At first glance, this indicates exceptional operational performance and alignment.

However, a closer look reveals a critical leadership issue: the perception of leadership declines from today to the future. This downward trend suggests employee concerns about the leadership team’s ability to guide the company through future challenges. Potential explanations include mismanagement, lack of confidence in strategic direction, or rumors of impending leadership changes. For InvestCo, this warrants immediate investigation to ensure Company D’s leadership aligns with its growth trajectory and employee expectations.

Company E: Misaligned Perception of Risk-Taking

Company E, a younger, technology-driven investment, operates on a platform-based model with a workforce predominantly under 50. Despite being externally viewed as the most risk-taking company in the portfolio, WTF data shows that its employees perceive themselves as the least risk-oriented, with curves closer to the center than other companies in both current and future states.

This misalignment raises interesting questions:

- Is Company E under consistent internal presssure to take more risks?

- Does the team lack an accurate understanding of its comparative risk profile within the portfolio?

For InvestCo, this presents an opportunity to leverage portfolio-wide insights to recalibrate Company E’s risk-taking perception and provide context relative to its peers. Understanding this dynamic can help InvestCo determine whether Company E should scale its risk profile up or down.

Strategic Implications for InvestCo

These findings underscore the value of WTF as a tool for identifying areas of opportunity and concern across individual portfolio companies. Key takeaways for InvestCo include:

- Prioritize High-Delta Investments: Companies like B, with greater future potential and larger deltas, represent stronger candidates for investment over companies nearing their growth ceilings, such as A.

- Leverage Technology Transformation: Company C highlights the need for increased technological adoption across traditional players to remain competitive and scalable.

- Address Leadership Gaps: The leadership decline at Company D is a red flag that requires immediate attention to prevent misalignment with future goals.

- Contextualize Risk Perceptions: The risk-taking misalignment at Company E suggests a need for cross-portfolio benchmarking to provide perspective and guide strategic adjustments.

- Tailor Strategies to Context: Insights must be interpreted within the broader organizational and market context, as seen with Company C’s alternative business model challenge, to avoid counterproductive shifts.

Through this level of granular analysis, InvestCo can make informed decisions to optimize its portfolio, allocate resources effectively, and address underlying challenges that may otherwise go unnoticed. WTF’s ability to surface actionable insights ensures that every investment decision aligns with long-term growth and ROI objectives.

Conclusion

InvestCo’s strategic deployment of WTF has provided a comprehensive, data-driven assessment of its internal dynamics and the performance of its portfolio companies. This analysis reveals a complex interplay of strengths, weaknesses, and opportunities that will shape the company’s future trajectory.

A significant finding is the disparity in perceptions across different levels of management. While the executive team may hold an optimistic view of the company’s future, middle and junior management may have a more nuanced perspective. This divergence highlights the need for improved communication, transparency, and alignment.

The analysis also underscores the importance of technology adoption as a key driver of growth and innovation. InvestCo must invest in technology infrastructure, upskill its workforce, and foster a culture of innovation to remain competitive.

Regarding the portfolio companies, the analysis reveals a diverse range of strengths and weaknesses. While some companies demonstrate strong growth potential, others may be facing challenges related to leadership, culture, or technology adoption. InvestCo can leverage this insight to prioritize investments, provide targeted support, and drive value creation.

WTF has provided a valuable tool for assessing InvestCo’s current state and future potential. By addressing the identified challenges and capitalizing on the opportunities, InvestCo can strengthen its position as a leading investment firm and deliver sustainable long-term value to its stakeholders.

Key Takeaways

- Leadership Alignment: InvestCo must bridge the perception gap between executive and lower-level management to foster a shared vision and drive strategic alignment.

- Technology Adoption: Investing in technology and digital transformation is crucial for remaining competitive and driving innovation.

- Portfolio Optimization: By identifying high-potential companies and addressing underperformance, InvestCo can optimize its portfolio and maximize returns.

- Cultural Transformation: Fostering a strong, innovative, and adaptive culture is essential for attracting and retaining top talent and driving long-term growth.

- Continuous Improvement: Regular assessments and feedback mechanisms are critical to monitor progress, identify emerging challenges, and adapt to changing market conditions.